washington state long term care tax opt out rules

After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. On January 27 2022 Washington Governor Jay Inslee signed House Bills 1732 and 1733 delaying and amending the Washington Cares Act often referred to as the Long-Term.

What S Next For Beleaguered Wa Long Term Care Program Crosscut

Private insurers may deny coverage based on age or health status.

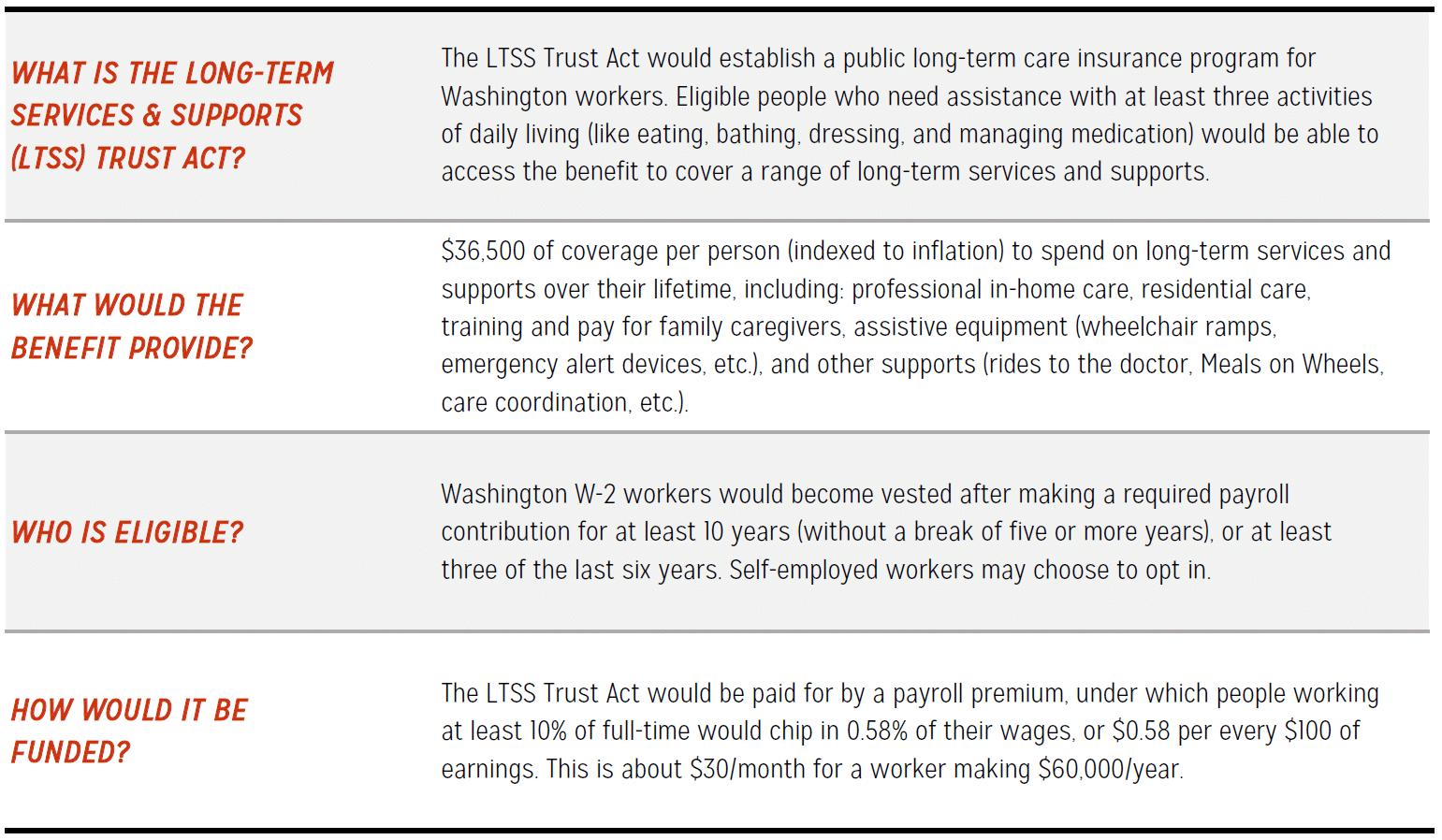

. Earlier this year we shared the details and planning implications of Washington States new long-term care tax the first such law passed in the United States. Up until the law was changed in March 2022 the only workers in Washington who were exempted from the program were those who owned long-term care insurance with an. As a reminder in April 2021 the Washington State legislature passed a law requiring individuals to 1 pay into a long-term care fund or 2 opt out of paying into the fund by proving that they.

WHAT IS THE TAX. LEARN ABOUT WA CARES. This mandatory program now slated to begin on July.

How do I opt out of WA cares. It will soon bring workers in our state a new payroll tax of 58 cents for every 100 of wages. The Washington Department of Insurance requires that long-term care insurance policies provide a minimum of TWO years of care.

Read more about the regressive tax and misguided law that created it here. Applications are available as of October 1 2021. Individuals who have private long-term care insurance may opt-out.

To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC. Sign up here to receive LTSS rulemaking updates. Under this law individuals will have access to a lifetime benefit amount that should they need it they can use on a wide range of long-term services and supports.

Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021. New State Employee Payroll Tax Law for Long-Term Care Benefits. With a maximum payout of 100 per day.

Long-Term Services and Supports LTSS is now called WA Cares Fund. The new mandate burdens. In that case the tax will be.

Visit us at wacaresfundwagov. The legislation provides a one-time window to opt out of this tax and waive the right to receive benefits under the public long-term care program by demonstrating that you. Last year the State of Washington passed the Washington LTC Trust Act and established the Washington Cares Fund.

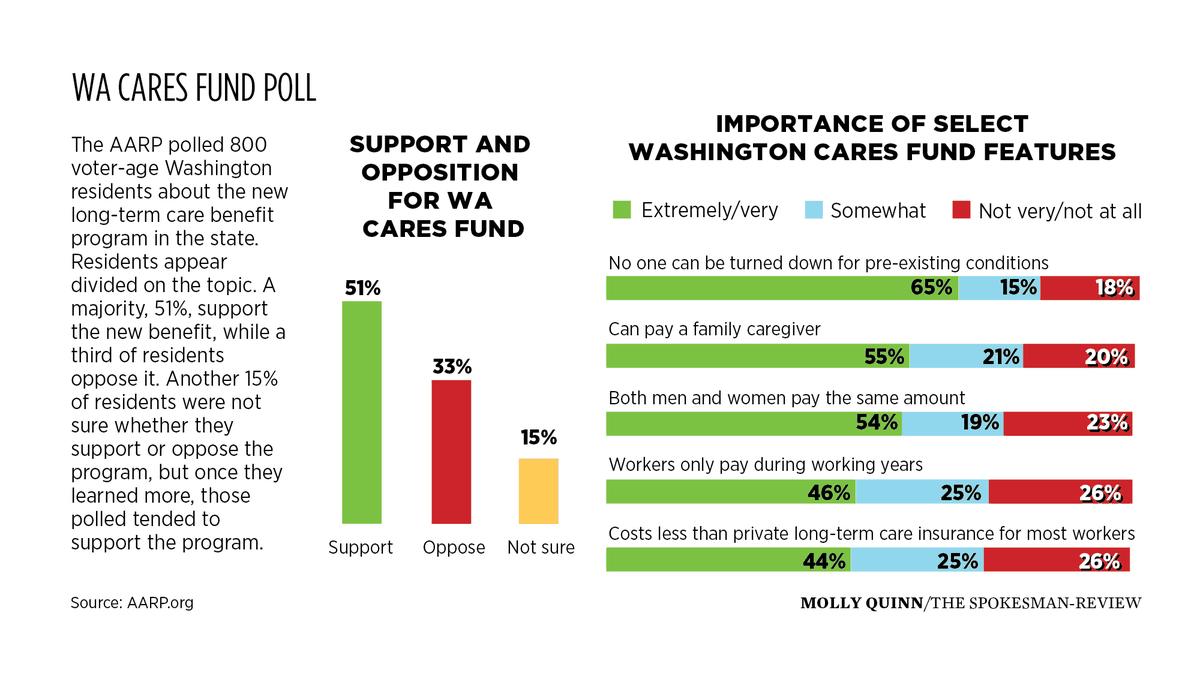

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. A delay of the long-term-care law that mandates the program and its tax was. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage.

This law concerning long-term care should be repealed by lawmakers.

Saving For Long Term Care In Washington What To Know Ahead Of Paycheck Deductions In January King5 Com

Major Changes To Washington State S Long Term Care Program Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Washington State Trust Act Should You Opt Out Buddyins

What To Know Washington State S Long Term Care Insurance

As Opposition Grows Washington S Long Term Care Tax To See Fixes In Legislature This Session The Spokesman Review

Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time Northwest Public Broadcasting

Can You Opt Out Of State S New Long Term Care Act And Tax Should You

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

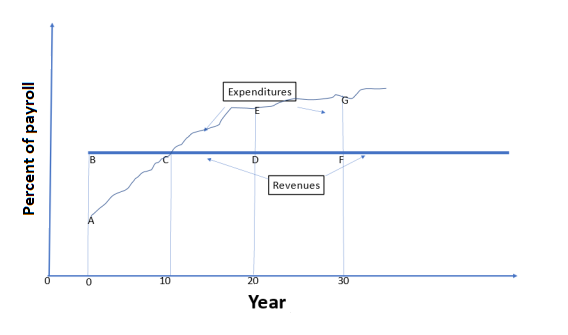

The Future Of Wa Cares A Response To Warshawsky

Washington Is Close To Making History On Long Term Care Budget And Policy Center

Repealing The Unpopular Long Term Care Insurance Program And Regressive Payroll Tax Washington State House Republicans

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 11 Bogleheads Org

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Opinion Long Term Care Payroll Tax The State Saw More Than 110 000 Exemption Requests As Of Sunday Clarkcountytoday Com

Long Term Care Insurance Washington State S New Law White Coat Investor

New Wa Long Term Care Tax Delayed So Legislature Can Fix It Crosscut